Energy Prices

The more drawn out the conflict in Ukraine goes on, the more prominent the danger of high oil costs to the US economy. That’s what our examination shows “more prominent danger” doesn’t mean a decline in the US is an inescapable result assuming costs stay “excessively high for a really long time.” There are different factors working. The first is energy costs.

The Russian attack on Ukraine is unleashing ruin on energy costs here and abroad. We have recently talked about our interest in extra recuperation in Europe due to those exorbitant costs. We presently direct our concentration toward the expected impact of high oil costs, essentially through gas and diesel fuel estimating, and the influences these exorbitant costs might have on the US economy. From a March 9 normal high in California ($5.573 for customary to $5.989 for diesel) to the most reduced in the country in Kansas ($3.792 to $4.437), broadened high siphon costs will repress some optional spending by buyers and nibble into benefits for certain callings (Lyft, limousine organizations, carriers, following organizations). An extraordinary arrangement really relies on how rapidly expenses/charges can be gone through to safeguard the business, which then prompts shopper value expansion and those related worries.

Prior to dunking into the subtleties, it is encouraged to remember that we entered this swamp with everything looking great monetarily:

- After-charge livelihoods are up (comparative with pre-COVID).

- Individual investment funds are at a post-Great-Recession typical level.

- Occupations are copious.

- Obligation administration levels as a level of Disposable Personal Income are low.

- Organizations’ liquidity is high.

- Benefits are up.

- Cash is modest (in both ostensible and genuine dollar terms).

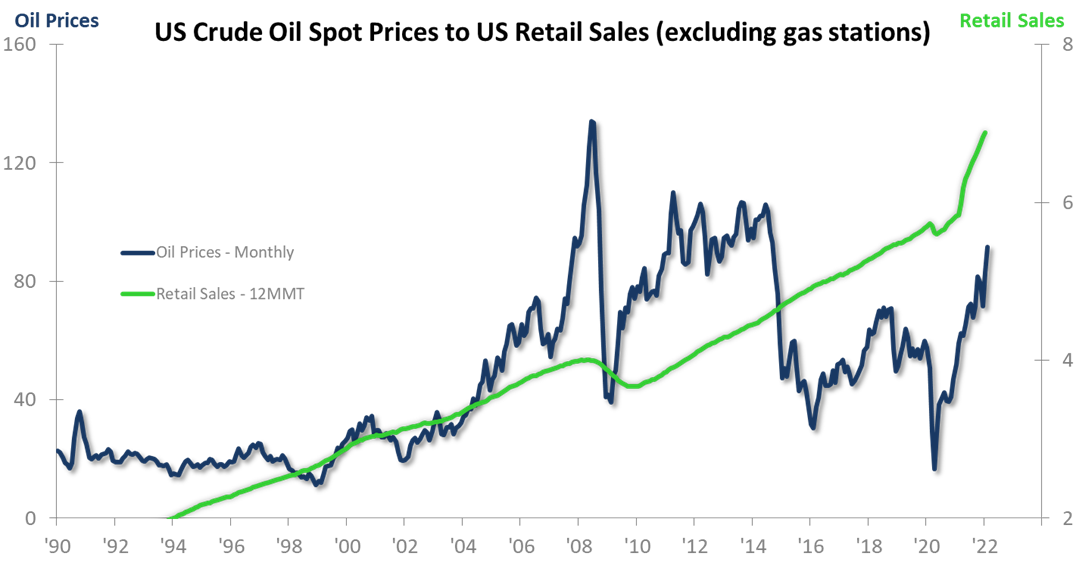

What High Fuel Prices Might Mean for Retail Sales

Everybody is discussing it or possibly mindful of it. Going to the fuel siphon is an eyebrow-raising event. The graph underneath proposes rising oil costs, which straightforwardly drive gas and diesel costs higher, don’t block Retail Sales climb (we are utilizing retail deals information barring service stations in order to stay away from a cost-swelled perspective on the pattern). The diagram shows that the Retail Sales pattern keeps on ascending notwithstanding the raised oil/fuel costs. What isn’t so clear is that the more exorbitant costs can lessen the pace of ascending in Retail Sales, albeit that itself is certainly not guaranteed. We suspect for this situation a compounding of elements might play into the outcome.

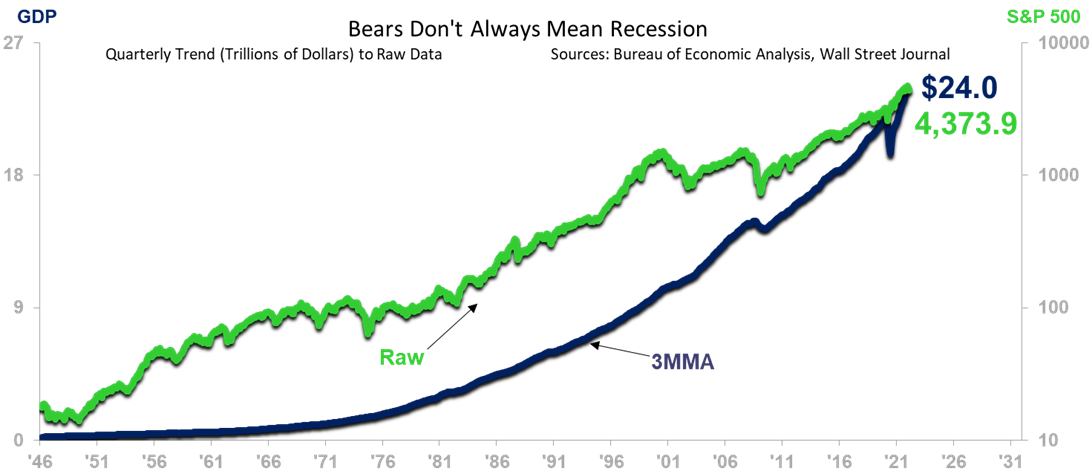

S&P 500 Weakness and GDP

We analyzed occurrences of when the S&P 500 slipped into a bear market and when there was a relating downturn in GDP (adapted to expansion). A bear market in the S&P 500 for our motivations is any decay of 15% or more prominent. Note that at the hour of this composition, the S&P 500 is in a rectification pattern (decline however under 15%, i.e., not a bear market). We keep on expecting that the ongoing S&P 500 pattern will stay one of revision and not bear market decline; in any case, regardless of whether it was to degenerate into a bear market, as some trepidation, it wouldn’t be a prompt reason to worry. We have encountered bear markets without a GDP downturn in numerous examples: 1966, 1976-78, 1987, 2000-02, and generally as of late in 2011. It pays to recollect that the financial exchange isn’t driven by similar essentials as the GDP business cycle.

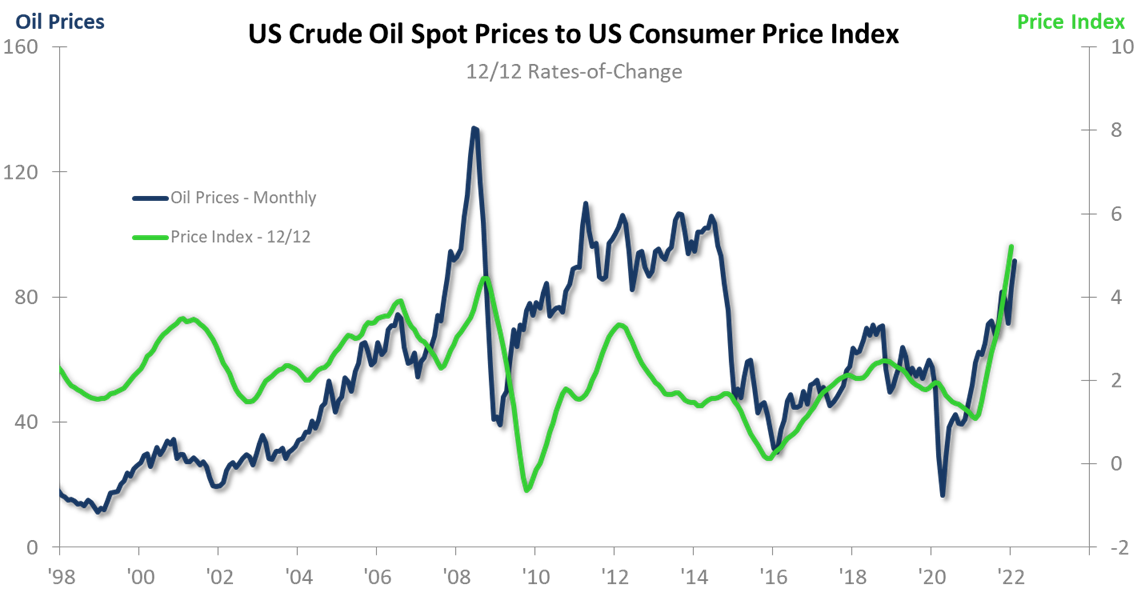

Higher Oil Prices Mean Elevated Inflation

The linkage between oil costs and expansion is more clear than the abovementioned. Higher oil costs (and consequently fuel and diesel costs, among other energy costs) will most frequently prompt higher expansion as estimated by the Consumer Price Index (CPI). While the expansion will ultimately bring down the way of life of individuals dwelling in the economy and will at last prompt horrifying lopsided characteristics, absolutely no part of that occurs in the momentary except if the Federal Reserve stays unafraid in its mission to head off current or future expansion. This might be the single most noteworthy danger presented by the higher oil costs. We can’t understand what the Federal Reserve will do/say until they meet in seven days’ time. There are more than adequate points of reference for the Fed not moving against higher oil costs and points of reference for when it has. Treating the size of the potential rate expansion in March could be the financial vulnerability forced by the conflict, shortcomings in the securities exchange, and the security market flagging that a critical rate climb isn’t required. We trust the Fed peruses the patterns the same way we are, and they keep themselves restricted to a 25-premise point increment, or 50 premise focuses and no more. All that truly matters is what the Fed’s examination says regarding the likely term of the Ukraine war and in this way these extremely high energy costs.

The CPI and product costs overall were in the beginning phases of moving from climb into lower paces of expansion and unobtrusive cost decline, separately, before Russia attacked. The conflict has obviously upset the ordinary course of financial aspects. This is typical; to be sure, it is typical for a conflict to do this. What is additionally ordinary is that after the conflict, the financial patterns will indeed win. That implies disinflation basically in all cases and lower fuel, diesel, warming oil, and propane costs (albeit not really back to pre-war levels).