The World’s Largest Real Estate Investment Trusts (REITs)

Real estate is generally viewed as an alluring resource class for financial backers.

This is on the grounds that it offers a few advantages like broadening (because of less connection with stocks), month-to-month pay, and insurance from expansion. The last option is known as “expansion supporting”, and originates from Real estate’s propensity to value during times of rising costs.

Reasonableness, obviously, is a significant hindrance to putting resources into the most Real estate. Property markets all over the planet have arrived at a bubble an area, making it extraordinarily hard for individuals to secure their opportunities.

Fortunately, there are simpler approaches to acquiring openness. One of these is buying partakes in a Real estate venture trust (REIT), a kind of organization that claims and works pay creating land, and is most frequently public.

What Qualifies as REIT?

To qualify as a REIT in the U.S., an organization should meet a few models:

- Put somewhere around 75% of resources in land, cash, or U.S. Depositories

- Determine somewhere around 75% of gross pay from rents, interest on home loans, or land deals

- Pay somewhere around 90% of available pay as investor profits

- Be an available partnership

- Be overseen by a top managerial staff or legal administrators

- Have something like 100 investors following one year of tasks

- Have something like a portion of its portions held by five or fewer individuals

Putting resources into a REIT is like buying portions of some other public corporation. There are likewise trade exchanged reserves (ETFs) and shared reserves which might hold a bin of REITs. Finally, note that a few REITs are private, meaning they aren’t exchanged on stock trades.

The Top 10 by Market Cap

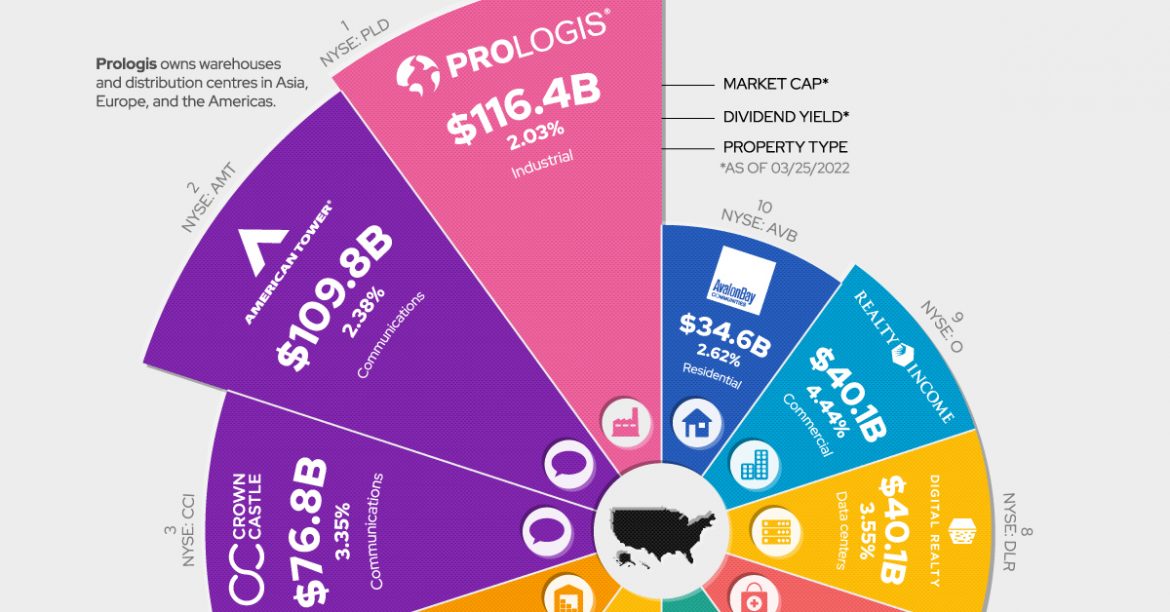

Here are the world’s 10 biggest public REITs, as of March 25, 2022.

| REIT | Market Cap | Dividend Yield | Property Type |

|---|---|---|---|

| Prologis (NYSE: PLD) | $116.4B | 2.03% | Industrial |

| American Tower (NYSE: AMT) | $109.8B | 2.38% | Communications |

| Crown Castle (NYSE: CCI | $76.8B | 3.35% | Communications |

| Public Storage (NYSE: PSA) | $65.9B | 2.14% | Self-storage |

| Equinix (NYSE: EQIX) | $64.4B | 1.74% | Data centers |

| Simon Property Group (NYSE: SPG) | $48.9B | 5.07% | Malls |

| Welltower (NYSE: WELL) | $43.0B | 2.58% | Healthcare |

| Digital Realty (NYSE: DLR) | $40.1B | 3.55% | Data centers |

| Realty Income (NYSE: O) | $40.1B | 4.44% | Commercial |

| AvalonBay Communities (NYSE: AVB) | $34.6B | 2.62% | Residential |

As displayed above, REITs center around various areas of the market. Understanding their disparities is a significant stage to consider prior to making a speculation.

For instance, Prologis deals with the world’s biggest arrangement of operations land. This incorporates stockrooms, dissemination focuses, and other store network offices all over the planet. It’s sensible to accept that this REIT would profit from additional development in web-based business — erring on this close to the end.

Realty Income, then again, possesses an arrangement of the north of 11,100 business land properties in the U.S. also, Europe. It leases these properties out to significant brands like Walgreens and 7-Eleven, which together record 8.1% of the REIT’s yearly pay.

Something beyond Buildings

Cell pinnacles and server farms may not appear as “Real estate”, however, they are both basic bits of present-day framework that take up land.

REITs that attention on these areas incorporates American Tower and Crown Castle, which own remote correspondences resources in the U.S. also, abroad. They are probably going to profit from the expanded reception of 5G organizations and the Internet of Things (IoT).

Then again, Equinix and Digital Realty are centered around server farms, a quickly developing industry that is profiting from digitalization. Both of these REITs work with significant tech firms like Amazon and Google.

Patterns to Watch

The interest in Real estate can be intensely impacted by general patterns viewed around the world. One of these is populace development and urbanization, which has radically pushed up the expense of lodging in numerous urban areas all over the planet.

There’s likewise the rising predominance of online business, which has set off a blast popular for distribution center space. This is best caught by Amazon’s huge development during the COVID-19 pandemic, during which the organization multiplied the number of its stockroom offices.

Universally, the web-based business represents only 19.6% of all out retail deals. Should that figure keep on rising, modern land costs could be available for hearty, long-haul development.